APPRAISALS & PUBLIC ADJUSTING

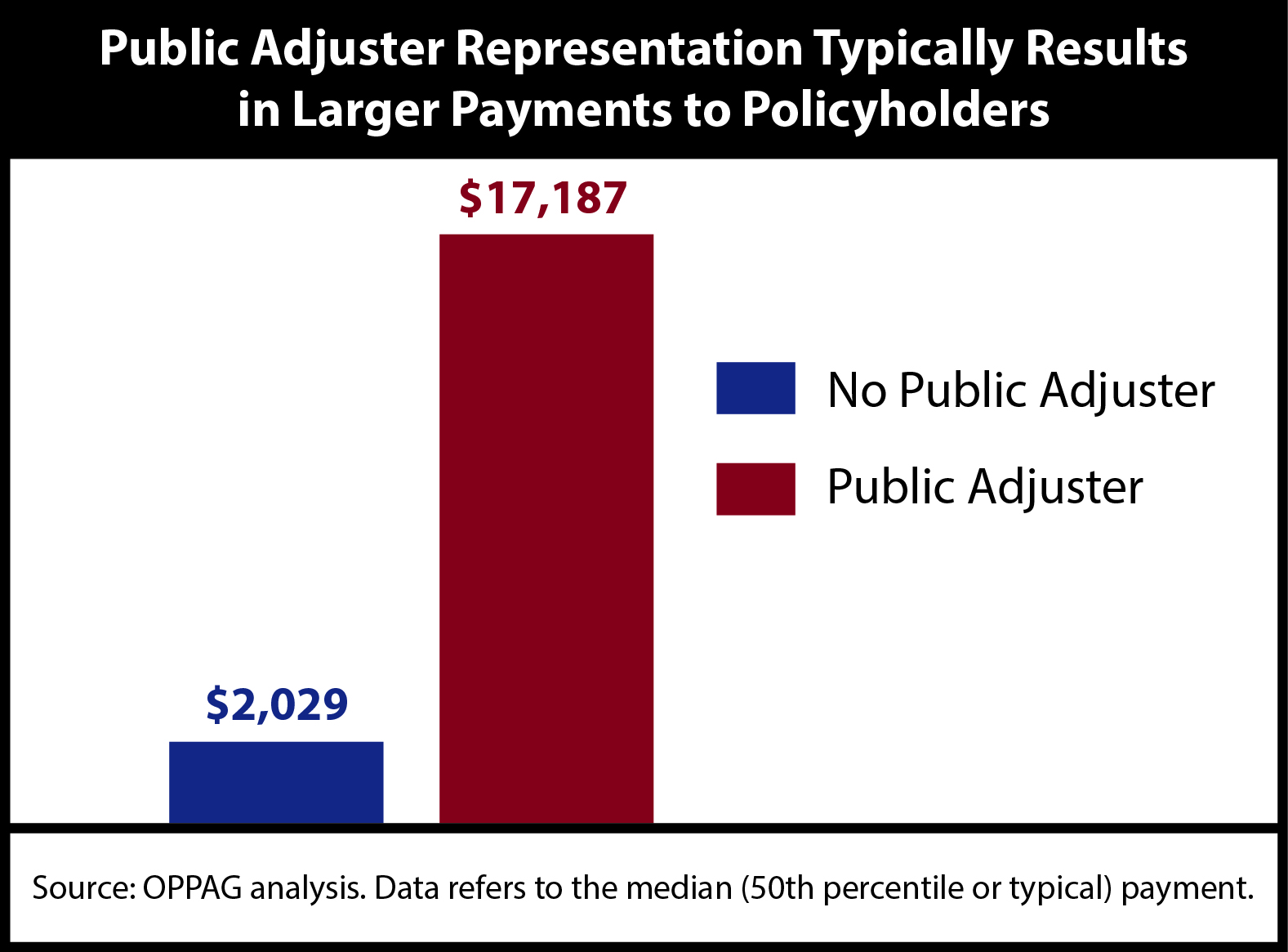

Unhappy with your insurance claim offer? Do you have a dispute with your insurance company for a settlement that is less than you think it should be? You may need to hire a public adjuster that can help you dispute it. For experienced insurance advocacy and expert appraisal representation, take your claim settlement to a higher level of competence and hire Kevin Aguilar, our licensed Public Adjuster. We offer a free consultation appointment. Please give us a call if we can help you!

Colorado Public Adjuster License 421188

STEPS OF PUBLIC ADJUSTING

PUBLIC ADJUSTING FREQUENTLY ASKED QUESTIONS

What is a public adjuster?

Are public adjusters in any way affiliated with insurance companies?

What could a public adjuster do for me?

How can a public adjuster better serve me over an insurance company adjuster?

Why should I hire a public adjusters to get what's rightfully due me?

Why can't my insurance agent or broker handle my claim?

Can I Prepare my own claim better than a public adjuster?

Why should I engage a public adjuster?

Why do I need help in filing an insurance claim?

What is the extent of a public adjusters responsibility?

How do public adjusters determine the actual loss?

Will my loss be settled quicker with the services of a public adjuster?

How do the public adjusters charge a fee?

In Summarizing, The Public Adjuster will:

TESTIMONIAL

At this point we had to go to the “Appraisal process,” where we and the insurance company hire each hire independent professional appraisers, who meet and come to a fair conclusion on the damages. My wife and I have never been through anything like this, but a friend of ours had and recommended Kevin Aguilar and Aguilar Construction Services. Mr. Aguilar came to Fort Collins, reviewed the damage and the insurance estimate, and said he would represent us.

Mr. Aguilar set up a meeting with the other appraiser and informed me of the date. I was present at their walk around and was very impressed by Mr. Aguilar’s professionalism dealing with the insurance co’s appraiser. When their negotiations were completed, Mr. Aguilar had convinced the other appraiser that our house needed to be completely resided and painted, adding $30,000 to the original insurance estimate. Mr. Aguilar submitted a revised estimate to the insurance company appraiser, the appraiser would sign it and send it on to the insurance company.

The story does not end their though. The appraiser for the insurance company had serious health problems and did not get the paperwork submitted to the insurance company. When Mr. Aguilar learned what had occurred and our settlement was in limbo, he went to our insurance company and worked directly with them to secure our settlement.

I would whole-hearted recommend Mr. Aguilar to anyone needing the services of a professional appraiser. He is detailed oriented, and kept us well informed as our case progressed. He looked out for us and made sure that our house can be restored to the condition it was before the storm. He knew that we had never been through this process and explained every step as we progressed. When the process met a roadblock, Mr. Aguilar stepped in and worked it out for us.